%20(1).png)

At the heart of every successful business lies a deep understanding of its customers—how to acquire them, keep them satisfied, and ensure they continue to engage with the brand. Two of the most important metrics that help businesses gauge this understanding are churn rate and retention rate. These metrics not only provide insight into customer loyalty but also highlight potential areas where a company may be falling short.

Failing to measure churn and retention rates is like running a restaurant without tracking customer satisfaction, menu popularity, or inventory levels. You might serve a full house one night, but if you're not paying attention to the details, you'll soon find yourself with empty tables and a dwindling customer base. In business terms, without these metrics, you won't know if your customers are happy with your product or service, or if you're losing them to competitors.

In this blog, we’ll break down the importance of these metrics, understand their formulas, and discuss the differences between churn and retention. We will examine why some companies experience high churn while others enjoy high retention. We’ll also explore how improving the client experience can significantly impact these metrics.

What is churn rate

Churn rate is a metric that measures the percentage of customers who stop doing business with a company over a specific period. This could mean they cancel a subscription, close an account, or simply stop buying products. Churn rate is a direct indicator of customer dissatisfaction or lack of engagement, and it’s crucial for businesses that rely on recurring revenue streams.

The formula for churn rate

The churn rate is calculated as follows:

For example, if a company had 1,000 customers at the beginning of the month and lost 50 by the end, the churn rate for that month would be 5%.

Metrics used to measure churn rate

To get a comprehensive view of churn, businesses often look at several related metrics:

- Gross churn rate

- Net churn rate

- Revenue churn rate

- Voluntary vs. involuntary churn

- Gross churn rate: Measures the percentage of total customers lost, regardless of any new customers gained.

Formula: Gross Churn Rate = (Number of Customers Lost During a Period / Total Number of Customers at the Start of the Period) x 100.

For example, if a company starts with 1,000 customers and loses 50, the gross churn rate would be 5%.

- Net churn rate: Takes into account new customers acquired during the period, providing a more balanced view.

Formula: Net Churn Rate = [(Number of Customers Lost - Number of New Customers Acquired) / Total Number of Customers at the Start of the Period] x 100.

For instance, if the company loses 50 customers but gains 20 new ones, the net churn rate would be 3%.

- Revenue churn rate: Focuses on the percentage of revenue lost due to churn, which can highlight issues in higher-value customer segments.

Formula: Revenue Churn Rate = (Revenue Lost from Churned Customers / Total Revenue at the Start of the Period) x 100.

If a company has $100,000 in revenue and loses $10,000 from churned customers, the revenue churn rate would be 10%.

- Voluntary vs. involuntary churn: Voluntary churn happens when customers consciously decide to leave, whereas involuntary churn may occur due to factors like payment failures or expired credit cards.

Example: If a company loses 100 customers in a month, 70 due to voluntary reasons (e.g., dissatisfaction) and 30 due to involuntary reasons (e.g., expired credit cards), understanding the distinction helps in targeting the right retention strategies.

What is retention rate

Customer retention is a key metric that directly affects revenue for your organization. Organizations that are growing rapidly need robust customer retention strategies.

Retention rate measures the percentage of customers a company retains over a specific period. High retention rates indicate that a company is successful in keeping its customers engaged and satisfied, leading to long-term loyalty.

The formula for retention rate

The Retention rate is calculated as follows:

For example, if a company had 1,000 customers at the start of the month, gained 100 new customers, and ended the month with 950 customers, the retention rate would be 85%.

Metrics used to measure retention rate

To better understand retention, businesses monitor various related metrics:

- Customer lifetime value (CLV): Indicates the total revenue a business can expect from a single customer over the course of their relationship.

The formula for CLV is:

CLV = Average Purchase Value x Average Purchase Frequency x Customer Lifespan

For example, if a customer spends $100 per purchase, buys three times a year, and remains a customer for five years, their CLV would be $1,500.

- Repeat purchase rate: The percentage of customers who make a second purchase, a good indicator of customer satisfaction.

The formula for repeat purchase rate is:

Repeat Purchase Rate = (Number of Customers Who Made Multiple Purchases / Total Number of Customers) x 100.

For instance, if 200 out of 500 customers make a second purchase, the repeat purchase rate is 40%.

- Customer satisfaction score (CSAT): A direct measure of customer satisfaction, often gathered through surveys.

CSAT is calculated as:

CSAT = (Number of Satisfied Customers / Number of Survey Responses) x 100. If 80 out of 100 survey respondents report being satisfied, the CSAT would be 80%.

- Net promoter score (NPS): Measures customer loyalty by asking how likely they are to recommend the company to others.

NPS is calculated by subtracting the percentage of detractors (those scoring 0-6) from the percentage of promoters (those scoring 9-10). For example, if 70% of respondents are promoters and 10% are detractors, the NPS would be 60.

While understanding these metrics helps in gauging customer sentiment and loyalty, it’s equally important to grasp the distinctions between churn rate and retention rate to manage and improve overall customer retention effectively.

Differences between churn rate and retention rate

Churn rate and retention rate are two sides of the same coin. Understanding the difference between churn and retention is key to leveraging these metrics effectively.

- Perspective: Churn rate focuses on the customers you’ve lost, while retention rate emphasizes those you’ve kept. Churn highlights the problem areas, whereas retention underscores what’s working well.

- Calculation method: The Churn rate is typically calculated using the number of customers lost, whereas the retention rate is calculated based on the number of customers retained.

- Impact on business: High churn rates suggest underlying issues such as poor customer service, lack of value, or better competition. High retention rates indicate customer satisfaction, loyalty, and likely long-term revenue growth.

- Time frame: Churn rate often requires more immediate attention, as it signals customers leaving in the short term. Retention rate, while still important in the short term, is often a better measure of long-term customer relationships.

- Business strategies: To reduce churn, businesses might focus on improving customer support, refining their product or service offerings, or implementing better communication strategies. To improve retention, businesses might invest in loyalty programs, personalized marketing, or regular customer engagement activities.

Why companies lose customers: Comparing high churn to high retention

Understanding why some businesses experience high churn rates while others enjoy high retention rates is crucial for developing strategies to improve customer loyalty.

Reasons for high churn rate

Here are the reasons why organizations have high churn rates:

- Poor customer service: A lack of responsive and helpful customer service can drive customers away. If issues aren’t resolved quickly and effectively, customers may decide to take their business elsewhere.

- Product or service quality issues: If the product or service fails to meet customer expectations, they are likely to churn. This could be due to defects, lack of features, or simply not delivering on promises.

- Lack of engagement: Companies that fail to keep their customers engaged through regular communication, updates, or offers may see higher churn rates.

- Better competitors: When competitors offer better pricing, features, or customer service, customers may switch, leading to higher churn rates.

- Complex onboarding process: If the process of getting started with a product or service is too complicated or time-consuming, customers may give up and churn early. An efficient onboarding process is a crucial step in reducing the churn rate.

Reasons for high retention rate

Here are the reasons why organizations have high retention rates:

- Exceptional client experience: Organizations that prioritize client experience often see higher retention rates. This includes personalized service, prompt support, and a seamless customer journey.

- High-quality products/services: Consistently delivering a product or service that meets or exceeds customer expectations keeps them coming back.

- Regular engagement: Businesses that regularly interact with their customers, through newsletters, promotions, or social media, keep themselves top of mind, which aids in retention.

- Loyalty programs: Rewarding clients for their loyalty can significantly improve retention rates. This could be through discounts, special offers, or exclusive access to new products.

- Continuous improvement: Businesses that listen to customer feedback and continuously improve their offerings are more likely to retain their customers.

Contrasting strategies: How hig churn and high retention companies diverge in their approaches

High churn rates lead to significant customer losses, which can hurt revenue and increase marketing and sales expenses. This often indicates deeper issues like poor customer satisfaction or product quality, damaging the brand's reputation. In contrast, high retention rates reflect strong customer loyalty, driving repeat purchases and reducing acquisition costs. Retained customers also help build deeper relationships, leading to long-term profitability and brand advocacy.

Businesses with high churn rates often adopt a reactive approach. They focus on quick fixes or band-aid solutions, such as offering discounts to prevent customers from leaving. However, this is often unsustainable and doesn’t address the root causes of churn.

On the other hand, businesses with high retention rates take a proactive approach. They invest in understanding their customers, delivering value consistently, and enhancing the overall client experience. These companies are often more successful in the long run, as they build strong, loyal customer bases that generate recurring revenue and positive word-of-mouth.

Let’s take a look at how churn and retention rates affect different industries with real-world examples.

Legal industry: Balancing retention and churn

In the legal industry, client relationships are often long-term, making retention very crucial. For instance, a law firm specializing in corporate law might experience churn if its clients feel that the firm is not adequately addressing their evolving needs. By regularly engaging clients with updates on relevant legal changes and offering proactive advice, the firm can improve its retention rate. This proactive approach helps clients see the value in the ongoing relationship, reducing the churn rate.

Consulting: Delivering tangible value

Consulting firms often face high churn rates when clients feel that the advice provided is not actionable or does not lead to measurable outcomes. A consulting firm can improve its retention rate by ensuring that its recommendations are closely aligned with the client’s business goals and by regularly checking in to track progress. McKinsey & Company, for example, maintains high retention rates by establishing strong relationships with its clients and consistently delivering results that exceed expectations.

Accounting: Consistency and expertise

In the accounting industry, clients expect consistent service and expert advice. A high churn rate might occur if clients feel their financial needs are not being adequately met, or if they encounter frequent errors in their accounts. By investing in continuous training for accountants and leveraging advanced accounting software to reduce errors, firms can increase their retention rates. Deloitte, for example, has built a reputation for its expertise and consistency, which helps it retain clients year after year.

Client experience: Your secret weapon against churn

In legal, consulting, and accounting, success hinges on meeting client needs through proactive engagement, consistent service, and delivering real value. Whether it’s a law firm keeping clients informed, a consulting firm tailoring advice to client goals, or an accounting firm ensuring accuracy, the focus is on building trust and showing value. This dedication to client satisfaction is key to keeping retention high and churn low.

Client experience plays a pivotal role in determining whether a business will have a high churn rate or a high retention rate. A positive client experience fosters loyalty, satisfaction, and repeat business, while a negative experience can quickly drive customers away. Businesses that invest in improving every touchpoint of the customer journey—from the first interaction to post-purchase support—are more likely to retain their customers.

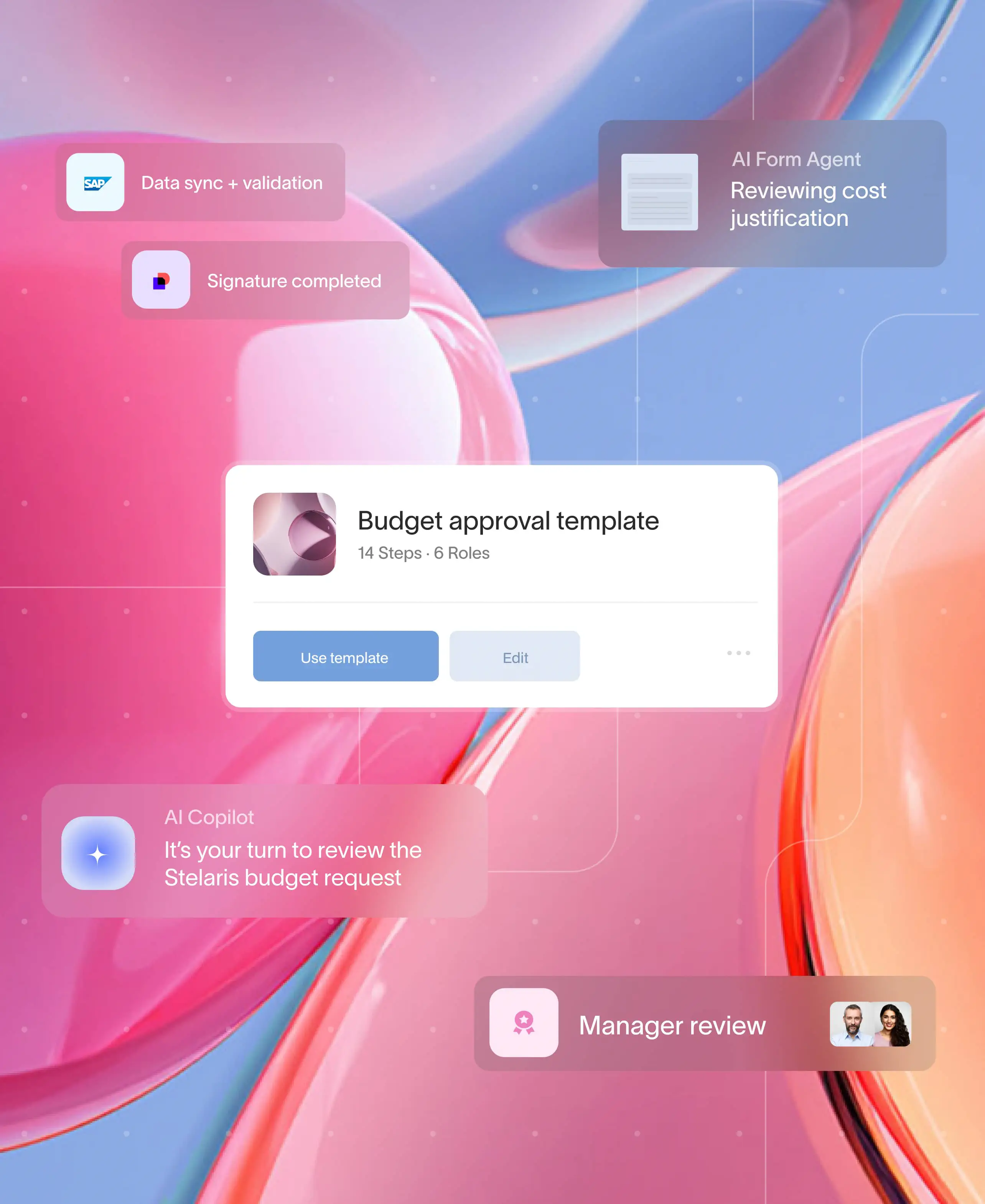

How Moxo enhances client experience and ensures a high retention rate

Moxo’s platform offers a comprehensive solution for businesses aiming to enhance their client experience and, consequently, improve their retention rates. Here’s a closer look at how Moxo’s features contribute to a superior client experience:

- Unified Client Communication: Moxo’s platform consolidates all client communications into a single, easy-to-use interface.

- Customizable Client Portals: Moxo allows businesses to create personalized client portals, tailored to the specific needs of each customer.

- Task Management and Workflow Automation: Moxo’s task management tools enable businesses to track client requests, assign tasks to the appropriate teams, and monitor progress in real-time.

- Secure and Collaborative Environment: Moxo provides a secure environment for all client interactions, including document sharing, communication, and project collaboration.

- Integration with Business Tools: Moxo seamlessly integrates with existing business tools and systems, ensuring that all client-related data is centralized and accessible.

Conclusion

Businesses that struggle with high churn rates often do so because of poor customer service, lack of engagement, or failure to meet customer expectations. On the other hand, businesses with high retention rates excel in delivering value, maintaining consistent communication, and fostering strong client relationships.

Understanding the differences and managing churn rate and retention rates are essential for long-term success. While these metrics are interrelated, they focus on different aspects of customer behavior—the churn rate of the customers who leave, and the retention rate of those who stay. By analyzing these metrics, businesses can identify areas for improvement and implement strategies that enhance the overall client experience.

Moxo provides a powerful platform that helps businesses improve their client experience by streamlining communication, offering personalized client portals, and ensuring secure and efficient collaboration. Get started today!

FAQs

How does the churn rate differ from the retention rate?

The churn rate and retention rate are not the same. The churn rate measures the percentage of customers who stop using a company’s product or service over a specific period, while the retention rate measures the percentage of customers who continue to use the product or service during the same period.

What is a good churn rate?

A "good" churn rate varies by industry, but generally, a lower churn rate is better as it indicates fewer customers are leaving. For subscription-based businesses, a churn rate below 5% is often considered good, though this can vary depending on the type of service and the competitive landscape.

How can I reduce my company’s churn rate?

To reduce churn, focus on improving customer satisfaction through better service, higher product quality, and more effective communication. Understanding why customers are leaving through feedback and addressing those issues can also help reduce churn.

What factors influence customer retention?

Customer retention is influenced by several factors, including product or service quality, customer support, pricing, and the overall client experience. Companies that consistently meet or exceed customer expectations tend to have higher retention rates.

How does Moxo help improve customer retention?

Moxo helps improve customer retention by enhancing the client experience through unified communication, personalized client portals, efficient task management, and secure collaboration.

Can high churn rates be turned around?

Yes, high churn rates can be turned around with the right strategies. This often involves addressing the root causes of churn, such as improving product quality, enhancing customer service, and increasing engagement efforts. Implementing feedback loops and continuously refining the customer experience are also