Every business aims for growth, but many overlook the treasure trove lying right under their noses: existing customers. Customer retention is not just a cost-saving strategy but a revenue-generating one. Loyal customers provide repeat business and become enthusiastic brand ambassadors. They spread positive word-of-mouth and drive new referrals without additional marketing costs. Understanding and improving customer loyalty and retention can significantly boost your bottom line.

But how do you measure and enhance this vital aspect of your business? This is where customer retention metrics come into play. By mastering these key metrics, you can identify areas for improvement, tailor your strategies effectively, and harness the full potential of your existing customer base. Customer retention metrics help you quantify the importance of retention by providing actionable insights. These insights will help you identify factors that affect customer satisfaction.

So, how can you harness this powerful asset? It all begins with mastering the customer retention metrics that matter.

A closer look at key customer retention metrics

It's crucial to understand which key customer retention metrics offer relevant insights into your customer retention efforts. Tracking the right metrics for customer retention allows you to make informed decisions, tailor strategies, and keep clients coming back for more. Here are the top customer retention KPIs every business should monitor:

- Customer retention rate (CRR)

- Customer churn rate (CCR)

- Repeat purchase rate (RPR)

- Customer lifetime value (CLV)

- Net promoter score (NPS)

- Customer effort score (CES)

- Average order value (AOV)

- Customer satisfaction score (CSAT)

Understanding these key customer retention metrics is the first step toward enhancing client loyalty and boosting overall business performance.

Let's delve deeper into each of these essential KPIs to understand their importance and how to measure them effectively.

1. Customer retention rate (CRR)

What it is

Customer retention rate measures the percentage of customers a business retains over a specific period. It reflects how successful a company is at satisfying customers and encouraging repeat business.

Why it matters

- Indicator of customer loyalty: A high CRR suggests that customers are satisfied and find value in your offerings.

- Revenue stability: Retained customers contribute to a consistent revenue stream, making financial forecasting more reliable.

- Cost efficiency: Retaining existing customers is cost-effective than acquiring new ones, as acquisition costs can be significantly higher.

Example: If you start the quarter with 1,000 customers, acquire 200 new ones, and end with 1,050 customers, your CRR is:

Action tip: Regularly calculate your CRR to assess the effectiveness of your retention strategies and identify trends over time.

Practical applications

- Identify loyalty drivers: Analyze factors that contribute to high retention, such as product features, customer service quality, or pricing models.

- Predict revenue: Use CRR to forecast future revenue streams and plan for growth or expansion.

- Resource allocation: Focus resources on strategies that enhance retention in high-value customer segments.

Ways to improve CRR

- Personalized customer journeys: Tailor experiences based on customer behavior and preferences using CRM systems and data analytics.

- Regular check-ins: Implement periodic reviews with customers to assess satisfaction and address concerns proactively.

- Loyalty programs: Develop programs that reward customers for continued business, such as exclusive discounts or early access to new features.

2. Customer churn rate

What it is

Customer churn rate represents the percentage of customers who stop using your product or service during a given period. It's a critical customer retention metric for understanding attrition.

Why it matters

- Revenue impact: Churn directly affects your bottom line; lost customers mean lost revenue.

- Growth challenges: High churn can offset the gains from new customer acquisition, making growth difficult.

- Customer insight: Understanding why customers leave provides valuable feedback for product and service improvements.

How to measure

Example: If you lose 50 customers out of 1,000 at the start of the month:

Action tip: Analyze churn reasons through exit surveys or follow-up calls to implement corrective measures.

Practical applications

- Early warning systems: Use churn data to develop predictive models that flag at-risk customers.

- Customer feedback loops: Implement exit surveys or interviews to understand the reasons behind churn.

- Service improvements: Adjust offerings based on feedback from churned customers to prevent future losses.

Ways to reduce churn

- Personalized retention efforts: Offer tailored incentives or solutions to at-risk customers, such as customized plans or discounts.

- Enhance product stickiness: Increase the number of touchpoints or integrations your product has with the customer's operations.

- Strengthen customer relationships: Build strong rapport through regular communication and dedicated account management.

3. Repeat purchase rate (RPR)

What it is

Repeat purchase rate is a key customer loyalty and retention metric. It calculates the percentage of customers who make more than one purchase within a specific period.

Why it matters

- Customer loyalty indicator: A high RPR suggests that customers are satisfied and willing to continue doing business with you.

- Revenue growth: Encouraging repeat purchases increases revenue without the need for new customer acquisition.

- Cost efficiency: It's generally less expensive to sell to existing customers than to acquire new ones.

How to measure

Example: If 300 out of 1,000 customers made more than one purchase last month:

Action tip: Encourage repeat purchases through loyalty programs, personalized offers, and exceptional customer service.

Practical applications

- Tailored marketing campaigns: Use purchase history to create personalized marketing campaigns that encourage repeat business.

- Customer experience enhancement: Improve the post-purchase experience to encourage customers to return.

- Loyalty programs: Implement programs that reward customers for repeat purchases, increasing engagement.

Ways to increase RPR

- Subscription services: Offer subscription models for products or services that customers need regularly.

- Automated reordering: Make it easy for customers to reorder products or renew services.

- Feedback integration: Use customer feedback to improve products and services, increasing the likelihood of repeat purchases.

4. Customer lifetime value (CLV)

What it is

Customer lifetime value is a key retention metric that measures customer loyalty. It estimates the total revenue a business can expect from a single customer account throughout its relationship with the company.

Why it matters

- Strategic investment decisions: Helps determine how much to invest in acquiring and retaining customers.

- Customer segmentation: Identifies which customers are most valuable over the long term.

- Profitability forecasting: Aids in predicting future revenue and profitability.

How to measure

Example: If the average purchase value is $100, customers buy twice a year, and the average customer lifespan is five years:

Action tip: Increase CLV by upselling, cross-selling, and enhancing customer satisfaction to extend the customer lifespan.

Practical applications

- Marketing budget allocation: Allocate marketing spending based on the potential CLV of different customer segments.

- Product development: Invest in features or services that increase CLV by enhancing customer satisfaction and retention.

- Pricing strategies: Adjust pricing models to maximize revenue from high CLV customers.

Ways to increase CLV

- Cross-selling and upselling: Introduce additional products or premium features that provide more value to the customer.

- Enhance customer engagement: Foster strong relationships through personalized communication and exclusive content.

- Extend customer lifespan: Implement customer retention strategies focused on long-term satisfaction.

5. Net promoter score (NPS)

What it is

Net promoter score is a KPI that measures customer loyalty and the likelihood of referrals by asking customers how likely they are to recommend your business to others.

Why it matters

- Predicts organic growth: A high NPS indicates that customers are willing to act as brand ambassadors.

- Customer satisfaction insight: Provides a quick gauge of overall customer satisfaction.

- Competitive benchmarking: Allows you to compare your performance against industry standards.

How to measure

- Survey question: "On a scale of 0-10, how likely are you to recommend our business to a friend or colleague?"

- Categorize respondents:some text

- Promoters (9-10)

- Passives (7-8)

- Detractors (0-6)

- Calculate NPS:

Example: If 60% are promoters and 15% are detractors:

Action tip: Use follow-up questions to gather insights from detractors and implement changes to improve their experience.

Practical applications

- Customer recovery: Reach out to detractors to resolve issues and improve their perception.

- Leverage promoters: Encourage promoters to share their positive experiences through testimonials and referrals.

- Improve product/service: Use feedback to make data-driven enhancements to your offerings.

Ways to improve NPS

- Customer experience mapping: Identify all touchpoints and optimize each for a better customer experience.

- Employee engagement: Ensure that employees are aligned with company values and customer-centric practices.

- Innovation: Continuously innovate to meet and exceed customer expectations.

6. Customer effort score (CES)

What it is

Customer effort score measures how easy it is for customers to interact with your company, particularly when solving issues or accessing services.

Why it matters

- Loyalty predictor: Customers who find it easy to get things done are more likely to stay loyal.

- Experience improvement: Identifies friction points in customer interactions.

- Competitive edge: Providing a low-effort experience can set you apart from competitors.

How to measure

- Survey question: "On a scale from 1 (very difficult) to 5 (very easy), how easy was it to resolve your issue today?"

- Calculate average score:

Example: If you receive a total score of 400 from 100 respondents:

Action tip: Identify high-friction areas in the customer journey and streamline processes to reduce effort.

Practical applications

- Process simplification: Streamline processes to reduce the steps required for customers to achieve their goals.

- Self-service resources: Provide comprehensive guides, FAQs, and tutorials to empower customers.

- Empower staff: Equip customer-facing teams with the authority and tools to resolve issues promptly.

Ways to improve CES

- Technology integration: Implement AI chatbots or virtual assistants for immediate support.

- Feedback loops: Use CES data to continuously refine customer journeys.

- Personalization: Tailor experiences based on customer history and preferences to reduce effort.

7. Average order value (AOV)

What it is

One of the important metrics to measure customer retention, average order value calculates the average amount spent each time a customer places an order with your company.

Why it matters

- Revenue optimization: Increasing AOV boosts revenue without acquiring new customers.

- Marketing efficiency: Higher AOV can improve the ROI of marketing campaigns.

- Customer behavior insight: Helps understand purchasing habits and preferences.

How to measure

Example: If your total revenue is $50,000 from 1,000 orders:

Action tip: Implement strategies like product bundling, upselling, and personalized recommendations to increase AOV.

Practical applications

- Dynamic pricing: Adjust pricing strategies based on customer behavior and market trends.

- Promotional offers: Use discounts or bundle deals to encourage larger purchases.

- Product recommendations: Implement recommendation engines to suggest additional products.

Ways to increase AOV

- Upselling techniques: Train sales teams to suggest premium products or add-ons.

- Cross-selling opportunities: Highlight complementary products during the purchase process.

- Minimum order incentives: Offer benefits like free shipping for orders over a certain value.

8. Customer satisfaction score (CSAT)

What it Is

CSAT measures how satisfied customers are with a specific interaction, product, or service.

Why it matters

- Immediate feedback: Provides real-time insights into customer perceptions.

- Service quality assessment: Helps evaluate the effectiveness of customer service efforts.

- Retention predictor: High satisfaction is often correlated with repeat business and loyalty.

How to measure

- Survey question: "How satisfied were you with your experience?" with a scale from 1 (very dissatisfied) to 5 (very satisfied).

- Calculate average score:

Example:

- Total Responses: 500

- Satisfied Responses (4 or 5): 400

Action tip: Use CSAT data to pinpoint areas needing improvement and to recognize high-performing teams or employees.

Practical applications

- Employee training: Use CSAT data to identify training needs for customer-facing staff.

- Service improvements: Address recurring issues highlighted in feedback to enhance service quality.

- Customer recovery: Follow up with dissatisfied customers to resolve issues and improve relationships.

Ways to improve CSAT

- Personalized interactions: Customize communications and offers based on customer preferences.

- Speed of service: Improve response times in customer support and service delivery.

- Quality assurance programs: Implement regular reviews and audits of customer interactions.

Combining customer retention metrics for a comprehensive view

Individually, each of these client retention metrics provides valuable insights. However, when analyzed together, they offer a holistic understanding of customer behavior and business performance, enabling more strategic decision-making.

Extended hypothetical example: TechStream B2B SaaS platform

Scenario

TechStream aims to grow its enterprise client base while maintaining strong relationships with existing customers. The company decides to analyze multiple customer retention metrics to inform their strategy.

Data points

- CRR: 95% overall, but only 85% in the small business segment.

- Churn rate: 5% overall, with a higher churn of 15% among small businesses.

- RPR: 25% overall, with enterprise clients at 40% and small businesses at 15%.

- CLV: $5,000 average, but $15,000 for enterprise clients and $2,000 for small businesses.

- NPS: 60 among enterprise clients, 40 among small businesses.

- CES: Average score of 2.0, with small businesses reporting higher effort scores.

- AOV: $1,200 overall, with enterprise clients averaging $2,000 per order.

- CSAT: 90% among enterprise clients, 75% among small businesses.

Analysis

- Segment-specific issues: Small businesses are experiencing higher churn rates, lower RPR, and lower CSAT scores.

- Customer effort: Small businesses report higher CES, indicating difficulties in using the platform.

- Value perception: Lower CLV and NPS among small businesses suggest they perceive less value from the service.

- Revenue impact: Despite making up a smaller portion of revenue, the high churn among small businesses affects overall growth.

Action plan

- Product adaptation for small businesses:

- Simplify the user interface to reduce the CES.

- Offer tiered pricing to make the platform more accessible.

- Enhanced support:

- Provide dedicated sessions for client onboarding for small businesses.

- Implement a knowledge base with resources tailored to small business needs.

- Feedback integration:

- Conduct focus groups to understand specific challenges faced by small businesses.

- Use CSAT and NPS feedback to make iterative improvements.

- Marketing adjustments:

- Shift focus towards acquiring more enterprise clients, who have higher CLV and lower churn.

- Develop case studies showcasing success stories among small businesses to improve trust.

- Customer engagement initiatives:

- Launch webinars and workshops to educate small business clients.

- Introduce a community forum for peer support and engagement.

Expected outcomes:

- Reduced churn: By addressing specific pain points, the churn rate among small businesses is expected to decrease from 15% to below 10%.

- Increased CLV: Improved satisfaction and ease of use should extend the customer lifespan, increasing CLV.

- Enhanced NPS and CSAT scores: Tailored support and product adjustments should boost satisfaction and likelihood to recommend.

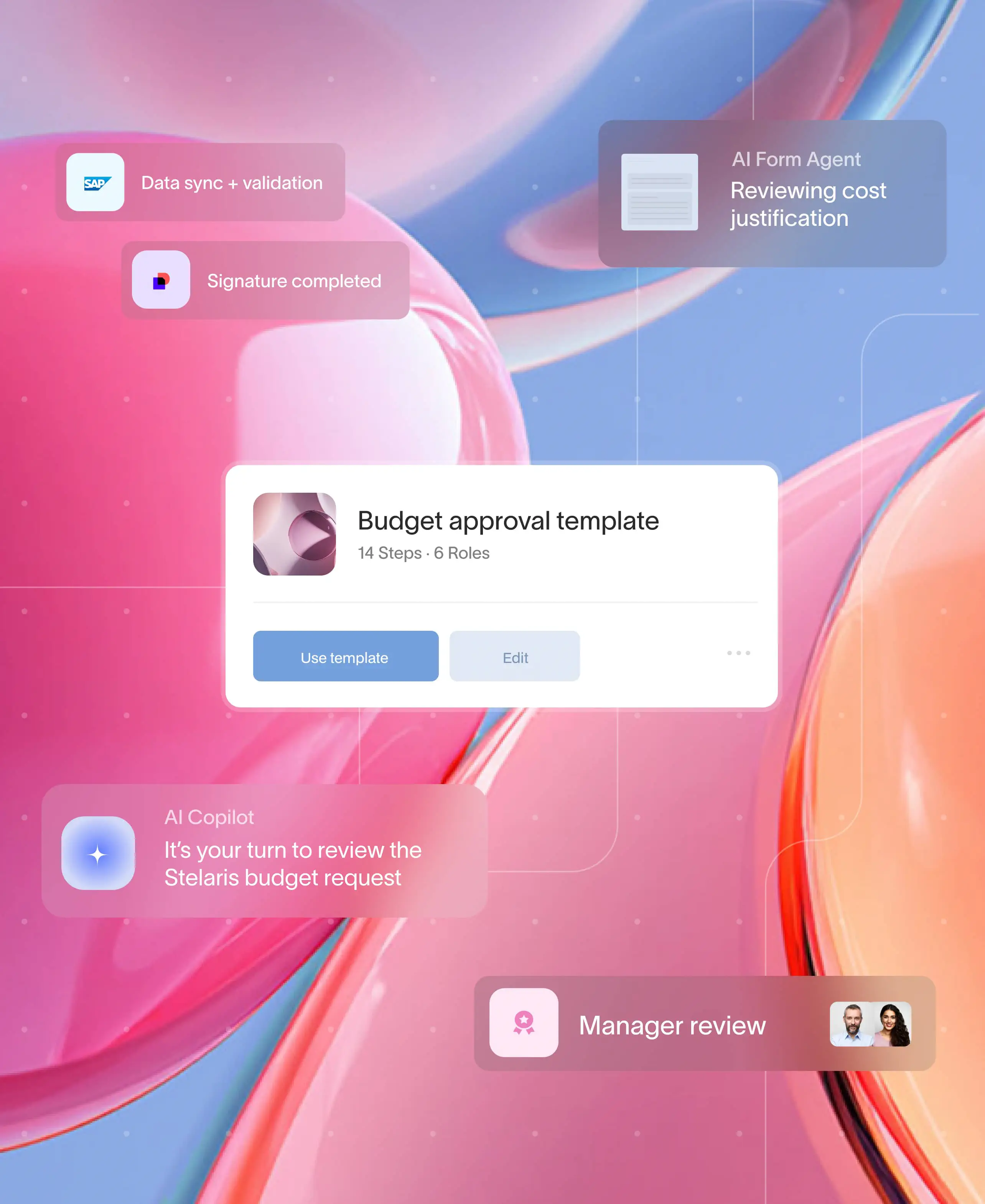

Retain customers more easily with Moxo

At Moxo, we believe that exceptional client experiences are the foundation of customer retention. Here's how Moxo can empower your business:

Seamless communication hub

Consolidate all client interactions—messages, documents, tasks, and meetings—into a single, intuitive platform. This reduces the customer effort score (CES) by making it effortless for clients to engage with your services.

Personalized client portals

Create customized client portals for each client, enhancing the customer experience and satisfaction score (CSAT). Personalized portals make clients feel valued and provide easy access to the information they need.

Efficient workflow automation

Automate routine tasks and workflows, freeing up your team to focus on building strong client relationships. Automation also reduces errors and speeds up service delivery, positively impacting your NPS.

Secure and compliant platform

Moxo offers enterprise-grade security features, ensuring client data is protected.

Streamlined project management

Simplify processes to accelerate time-to-value for clients with best in class project management.

Easier onboarding

Create the kind of customer onboarding experience you want with Moxo’s customizable onboarding.

By integrating Moxo into your operations, you're not just adopting a tool—you're embracing a partner dedicated to elevating your client experience and driving retention.

Get started with Moxo to improve your customer retention metrics with better engagement.

Conclusion

Understanding the metrics is essential to mastering customer loyalty and retention. These client retention metrics provide a roadmap for understanding your customers on a deeper level, allowing you to tailor experiences that keep them engaged and loyal.

Remember:

- Data-driven decisions: Use the insights from client retention metrics to make informed decisions that align with customer needs.

- Customer-centric culture: Foster a culture that prioritizes customer satisfaction and ease of experience.

- Continuous improvement: Regularly review and adjust your strategies based on metric trends and customer feedback.

By prioritizing these key customer retention metrics and leveraging innovative solutions like Moxo, businesses can transform their client relationships, leading to increased loyalty, advocacy, and long-term success.

Get started with Moxo to improve your customer retention metrics with better engagement.

FAQs

What is the most crucial metric among customer retention KPIs?

While all customer retention metrics offer valuable insights, the Customer Lifetime Value (CLV) is often considered the most crucial. It encapsulates the total worth of a customer to your business over time, guiding investment in retention strategies. However, focusing solely on CLV isn't enough; it's essential to balance it with metrics like CRR and NPS for a comprehensive understanding.

Why is net promoter score (NPS) important for my business?

NPS is a strong indicator of customer loyalty and the likelihood of referrals. A high NPS means customers are willing to recommend your business, leading to organic growth. It also helps identify detractors who may be at risk of churning, allowing you to take corrective action.

How often should I measure these customer retention metrics?

The frequency of measuring client retention KPIs depends on your business model and customer interaction frequency. For dynamic environments like e-commerce, monthly tracking may be appropriate. For industries with longer sales cycles, quarterly or bi-annual assessments might suffice. Regular monitoring allows for timely interventions and strategy adjustments.

How does improving customer effort score (CES) impact retention?

A lower CES means customers find it easy to interact with your business, which leads to higher satisfaction and loyalty. When customers encounter fewer obstacles, they're more likely to continue using your services and recommend them to others.

What role does customer feedback play in enhancing CLV?

Customer feedback provides insights into what customers value and what areas need improvement. By acting on feedback, you can enhance the customer experience, leading to increased purchase frequency and extended customer lifespan, thereby boosting CLV.