.webp)

Imagine being the CEO of a software company that provides project management tools to large enterprises. You need to ensure that you issue an invoice to a client on time to avoid delays in payment. If you don't receive payment on time, you may struggle to cover your upfront expenses, including salaries, infrastructure, and research and development costs. This is where timely and correctly invoicing is important.

Sending invoices promptly ensures steady cash flow. But it's not just about cash flow. Timely invoicing also shows professionalism and respect for your client's financial planning. It helps avoid disputes or confusion that can lead to payment delays. Moreover, it aids both your and your client's financial planning and budgeting.

Understanding the best way to invoice clients is crucial. The customer invoicing process can be streamlined by adopting best practices in invoicing for services. Knowing when to invoice a customer, whether you're figuring out how to invoice a client for services or the best way to invoice customers, can make a significant difference. By mastering how and when to invoice a customer, you can ensure smooth transactions and maintain positive client relationships.

How to invoice a customer

Understanding when clients typically make payments is crucial for effective billing. Knowing when to issue an invoice with their payment cycles enhances the chances of receiving timely payments. This strategic approach ensures invoices are submitted when clients are most likely to process them, seamlessly integrating into their financial operations.

Leveraging automation tools

The use of automation tools plays a pivotal role in facilitating prompt billing. Implementing systems that automatically generate and dispatch invoices right after services are provided helps reduce human errors and delays. This not only saves time but also strengthens a reliable billing procedure, which is essential for nurturing strong business-client relationships.

Technology and Invoicing Efficiency

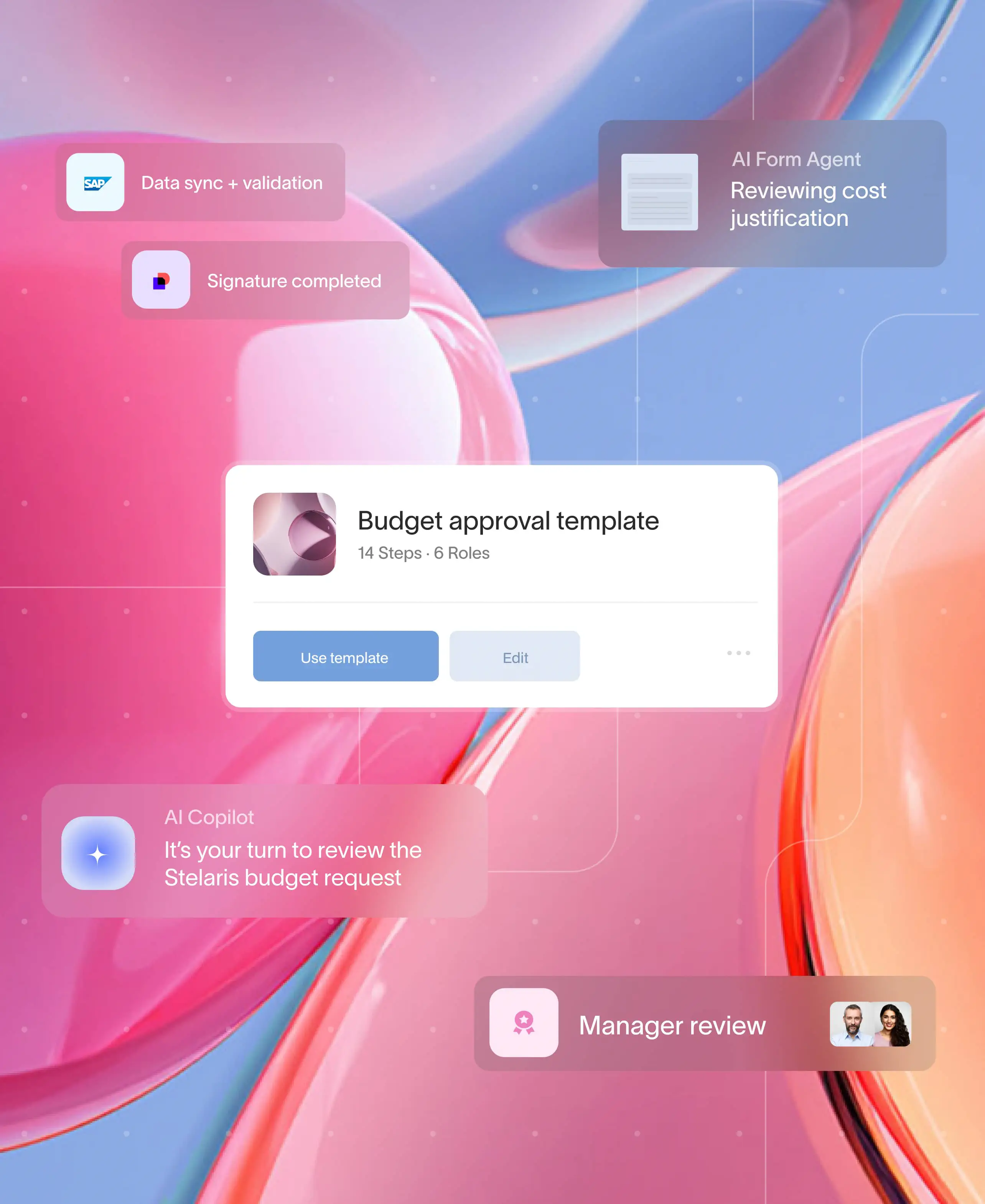

Technology comes to the rescue by taking the pain out of invoicing. One of the main issues organizations face is following up with their customers for timely payments. Moxo has helped hundreds of organizations put in place best practices that ensure invoices are sent on time and an audit trail is auto-created. You can also set up automations with workflows that send out reminders for payment automatically with Moxo.

Best practices while issuing invoices

To effectively invoice a client,

- Start by ensuring your invoice is clear and detailed. Include your company’s information, the client's details, a unique invoice number, and a breakdown of the services provided with corresponding costs.

- Specify payment terms and due dates to avoid any confusion.

- Issue an invoice promptly after the service is completed to maintain cash flow.

- Consider using invoicing software to automate and track invoices, making the process more efficient.

- Regularly follow up on overdue invoices with polite reminders to encourage timely payments.

Why timely invoicing matters

The longer an invoice sits, the more it loses its sense of urgency. It’s good to have a game plan around when to send an invoice. When an overdue invoice finally reaches a client, it's already playing catch-up. It's like trying to start a race from behind - the clock is ticking, and the odds are against you.

Even if the client intends to pay, they may have already allocated their available funds to more timely invoices from other vendors. As a result, your invoice gets pushed to the back of the line, increasing the likelihood of late payment or, worse, no payment at all. It's a frustrating cycle that can be avoided with timely and proactive invoicing.

Cash flow: Prompt invoicing leads to timely payments, ensuring steady cash flow. This is particularly important for businesses that have a lot of upfront expenses to take care of before delivering their service.

Healthy client relationship: Timely invoices show professionalism and respect for your client's financial planning.

Avoiding delays: Delayed invoices can result in disputes or confusion, causing payment delays.

Budgeting and forecasting: Timely invoicing aids both your and your client's financial planning.

When to invoice

Do you send an invoice before or after service is completed? This is a common question that many organizations struggle with. The answer depends on your business model and industry. Here are four common scenarios:

- Before Payment: Prepayment invoicing is common in industries requiring deposits or upfront payments, like event planning or construction. It assures client commitment and secures initial funding.

- After Payment: Suitable for subscription services or ongoing projects with recurring payments.

- Before Service: Ideal for projects with defined deliverables and timelines.

- After Service: Common in consulting, freelance work, and industries where final costs are determined post-completion.

Streamlining client invoicing with Moxo

Moxo is a client interaction hub that helps streamline communication and invoicing for clients, vendors and external partners. Here's how:

- Centralized communication: A single platform for client interactions, reducing miscommunication. As your business grows you can easily scale up with Moxo. We grow with you!

- Secure client portals: Clients can view invoices, make payments, and track project progress. Moxo is trusted by leading banks and financial institutions. We are SOC 2 and SOC 3 compliant and undergo regular third-party audits.

- Automated workflows: Automate reminders and follow-ups for timely payments.

- Integrations: Seamlessly integrates with accounting software for smooth data flows. You can set up Moxo to send automated invoice reminders and check up on clients who are late at making payments.

- Reduce complexity: With Moxo workflows you can reduce complexity as the number of invoices can increase exponentially as your business grows.

- Dashboards and analytics: Moxo has detailed analytics that let you track the progress on invoice payments and keep track of clients that are late with payments automatically.

- Automatically created audit trail: As interactions with clients are stored on our cloud platform, you can access old conversations, receipts to ensure your business is always compliant under regulatory laws.

Conclusion

Knowing when to invoice a customer using the right methods can significantly impact your business's cash flow and client relationships. By understanding your clients' needs and using tools like Moxo, you can create an efficient and professional invoicing process. Moxo lets you invoice customers seamlessly. Get started with Moxo now.

FAQs

When isthe best time to send an invoice?

It depends on your business model. Law firms may often invoice during the project, while subscription services bill before the next cycle.

Is it better to invoice before or after service?

It depends on your industry. Pre-service invoicing works well for businesses requiring deposits or upfront payments, while post-service invoicing suits consulting and freelancing industries.

How can I reduce payment delays?

Payment delays can significantly impact your business. Follow the tips below to reduce payment delays:

- Send invoices promptly.

- Use clear, concise language.

- Set and communicate payment terms upfront.

- Automate reminders using platforms like Moxo.

What are the essential components of an invoice?

The essential components of an invoice are:

- Business and client information

- Invoice number and date

- Description of services/products

- Payment terms and due date

- Total amount due

- Accepted payment methods

How can Moxo help streamline my invoicing process?

With Moxo, you can create automated workflows, and integrate third-party tools to simplify invoicing and communication.

Can I send invoices via multiple methods?

Yes, you can send invoices through multiple channels. Different channels you can use to send invoices are email, postal mail, or use a client portal like Moxo.

What should I do if a client disputes an invoice?

If a client disputes an invoice,

- Review the invoice and supporting documentation.

- Communicate with the client to understand their concerns.

- Clarify misunderstandings and provide additional information if needed.

- Negotiate a resolution or payment plan if appropriate.

How do automated reminders help with invoicing?

Automated reminders help clients remember about upcoming payment deadlines, reducing the chances of late payments. Platforms like Moxo can automate these reminders, saving you time and ensuring consistent follow-up.